IPO GMP CALCULATOR

How To Use GMP Calculator :

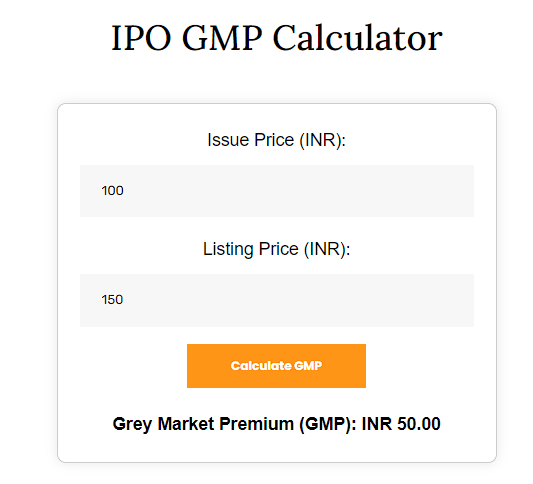

- Enter the issue price: Enter the issue price of the IPO in INR (Indian rupees). This is the price at which the company is offering its shares to investors.

- Enter the listing price: Enter the expected or actual listing price of the IPO in INR. This is the price at which shares are expected to start trading on a stock exchange.

- Calculate GMP: Click on the “Calculate GMP” button. The calculator will then display Grey Market Premium (GMP), which is the difference between the listing price and the issue price.

How to use Grey Market Premium [GMP] to invest in an IPO:

Here are some tips on how to use Grey Market Premium [GMP] to invest in an IPO

- Compare GMP with Historical Data:

You can compare the GMP of an IPO with the GMP of similar or previous IPOs that have listed in the past. This can help you gauge the demand and popularity of the IPO and how it might compare with its peers. For example, if an IPO has a higher GMP than its competitors or predecessors, it might indicate that the IPO is more attractive and likely to list at a higher price. - Track GMP Trends:

You can track the GMP trends of an IPO over time and see how it changes before the listing day. This can help you understand the sentiment and expectations of investors and the market. For example, if the GMP of an IPO is increasing over time, it might indicate that the IPO is gaining more interest and demand and is likely to list at a higher price. On the other hand, if the GMP of an IPO is decreasing over time, it might indicate that the IPO is losing its appeal and demand and is likely to list at a lower price. - Use GMP as a Reference Point:

You can use GMP as a reference point to decide whether to apply for an IPO or not. For example, if the GMP of an IPO is positive and high, it might indicate that the IPO is worth applying for, as you might get a good return on your investment. However, you should also consider the risk involved, as the GMP might not reflect the actual listing price and the IPO might list at a lower price than expected. On the other hand, if the GMP of an IPO is negative or low, it might indicate that the IPO is not worth applying for, as you might incur a loss on your investment. However, you should also consider the opportunity involved, as the GMP might not reflect the actual listing price and the IPO might list at a higher price than expected.

Frequently Asked Questions

GMP, or Grey Market Premium, is calculated by subtracting the issue price of the IPO from the current market price of the shares in the grey market. The formula is: GMP = Grey Market Price – IPO Issue Price.

To calculate GMP, you need to know both the IPO issue price and the current market price of the shares in the grey market. The formula is: GMP = Grey Market Price – IPO

A positive GMP is generally considered favorable, as it suggests that there is a demand for the IPO in the secondary market. However, what constitutes a “good” GMP can vary based on market conditions and individual investor perspectives.

The IPO amount is calculated by multiplying the number of shares offered in the IPO by the issue price per share. It represents the total value of the shares being issued to the public.

You can check the IPO GMP online through ipomentor.in website, or app. This platform usually provide real-time updates on the Grey Market Premium for different IPOs.

To check if ipomentor.in provides an IPO GMP calculator, you can visit the website directly and navigate to the IPO-related section or calculators related to Grey Market Premium (GMP) for IPOs.

Let’s say an IPO is issued at a price of INR 100 per share, and in the grey market, the current market price is INR 120 per share. The GMP would be INR 20 (GMP = 120 – 100). This suggests a positive demand for the IPO in the secondary market.

Disclaimer

Stock Market investments are subject to market risks. All the information provided on our IPO Mentor Portal is for education purposes only. Kindly consult your Financial Advisor before taking any decision.